Ponzi scheme

From Wikipedia, the free encyclopedia

A Ponzi scheme is a fraudulent investment operation that pays returns to separate investors from their own money or money paid by subsequent investors rather than from any actual profit earned. The Ponzi scheme usually offers returns that other investments cannot guarantee in order to entice new investors, in the form of short-term returns that are either abnormally high or unusually consistent. The perpetuation of the returns that a Ponzi scheme advertises and pays requires an ever-increasing flow of money from investors in order to keep the scheme going.

The system is destined to collapse because the earnings, if any, are less than the payments. Usually, the scheme is interrupted by legal authorities before it collapses because a Ponzi scheme is suspected or because the promoter is selling unregistered securities. As more investors become involved, the likelihood of the scheme coming to the attention of authorities increases.

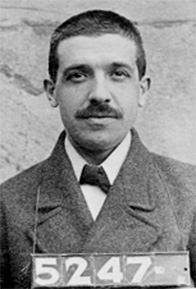

The scheme is named after Charles Ponzi,[1] who became notorious for using the technique after emigrating from Italy to the United States in 1903. Ponzi did not invent the scheme (Charles Dickens' 1857 novel Little Dorrit described such a scheme decades before Ponzi was born, for example), but his operation took in so much money that it was the first to become known throughout the United States. His original scheme was in theory based on arbitraging international reply coupons for postage stamps, but soon diverted investors' money to support payments to earlier investors and Ponzi's personal wealth.

Knowingly entering a Ponzi scheme, even at the last round of the scheme, can be rational economically if government bails out those participating in the Ponzi scheme.[2]

Contents |

Hypothetical example

Suppose an advertisement is placed that promises extraordinary returns on an investment — for example, 20 percent on a 30-day contract. The objective is usually to deceive laymen who have no in-depth knowledge of finance or financial jargon. Verbal constructions that sound impressive but are essentially meaningless will be used to dazzle investors: terms such as "hedge futures trading," "high-yield investment programs," "offshore investment" might be used. The promoter will then proceed to sell stakes to investors — who are essentially victims of a confidence trick — by taking advantage of a lack of investor knowledge or competence. The Madoff scandal of 2008 showed that investors presumed to be sophisticated, such as hedge fund managers and international bankers, can also be tricked into joining a Ponzi scheme by a promoter with a well-established (if spurious) reputation for financial skill. Claims of a "proprietary" investment strategy, which must be kept secret to ensure competitive edge, may also be used to hide the nature of the scheme. Bernard Madoff, for example, permitted only one accounting firm, run by his brother-in-law, to perform audits on his hedge fund, claiming the need to keep his strategy secret.Without the benefit of precedent or objective prior information about the investment, only a few investors are tempted, usually for small sums. Thirty days later, the investor receives the original capital plus the 20 percent return. At this point, the investor will have more incentive to put in additional money and, as word begins to spread, other investors grab the "opportunity" to participate, leading to a cascade effect deriving from the promise of extraordinary returns. However, the "return" to the initial investors is being paid out of the investments of new entrants, and not out of profits.

One reason that the scheme initially works so well is that early investors — those who actually got paid the large returns — commonly reinvest their money in the scheme (it does, after all, pay out much better than any alternative investment). Thus, those running the scheme do not actually have to pay out very much (net) — they simply have to send statements to investors showing them how much they earned by keeping the money, in order to maintain the deception that the scheme is a fund with high returns.

Promoters also try to minimize withdrawals by offering new plans to investors, often where money is frozen for a longer period of time, in exchange for higher returns. The promoter sees new cash flows as investors are told they could not transfer money from the first plan to the second. If a few investors do wish to withdraw their money in accordance with the terms allowed, the requests are usually promptly processed, which gives the illusion to all other investors that the fund is solvent.

The catch is that at some point one of three things will happen:

- The promoter will vanish, taking all the remaining investment money (minus the payouts to investors) with him.

- The scheme will collapse under its own weight as investment slows and the promoter starts having problems paying out the promised returns (the higher the returns, the greater the chance of the Ponzi scheme collapsing). Such liquidity crises often trigger panics, as more people start asking for their money, similar to a bank run.

- The scheme is exposed because the promoter fails to validate the claims when asked to do so by legal authorities.

Similar schemes

- A multilevel pyramid scheme is a form of fraud similar in some ways to a Ponzi scheme, relying as it does on a mistaken belief in financial reality, including the hope of an extremely high rate of return. However, several characteristics distinguish these schemes from Ponzi schemes:

- In a Ponzi scheme, the schemer acts as a "hub" for the victims, interacting with all of them directly. In a multilevel scheme, those who recruit additional participants benefit directly. (In fact, failure to recruit typically means no investment return.)

- A Ponzi scheme claims to rely on some esoteric investment approach (insider connections, etc.) and often attracts well-to-do investors; whereas multilevel schemes explicitly claim that new money will be the source of payout for the initial investments.

- A multilevel scheme is bound to collapse much faster because it requires exponential increases in participants to sustain it. By contrast, Ponzi schemes can survive simply by persuading most existing participants to "reinvest" their money, with a relatively small number of new participants.

- A bubble: A bubble relies on the willing suspension of disbelief and an unrealistic expectation of large profits, but it is not the same as a Ponzi scheme. A bubble involves ever-rising (and unsustainable) prices in an open market (be that shares of a stock, housing prices, the price of tulip bulbs, or anything else). As long as buyers are willing to pay ever-increasing prices, sellers can get out with a profit, and there doesn't need to be a schemer behind a bubble. (In fact, a bubble can arise without any fraud at all - for example, housing prices in a local market that rise sharply but eventually drop sharply because of overbuilding.) Bubbles are often said to be based on the "greater fool" theory. Although, according to the Austrian Business Cycle Theory, bubbles are caused by expanding the money supply beyond what genuine capital investment supports, and in this case would qualify as a Ponzi scheme, with expanded credit taking the place of an expanded pool of investors.

- "Robbing Peter to pay Paul": When debts are due and the money to pay them is lacking, whether because of bad luck or deliberate theft, debtors often make their payments by borrowing or stealing from other investors they have. It does not follow that this is a Ponzi scheme, because from the basic facts set out there is no indication that the lenders were promised unrealistically high rates of return via claims of unusual financial investments. Nor (from these basic facts) is there any indication that the borrower (banker) is progressively increasing the amount of borrowing ("investing") to cover payments to initial investors.

- Multi-level marketing: Multi-level marketing (MLM), a marketing strategy that compensates promoters of direct selling companies not only for product sales they personally generate, but also for the sales of others they introduced to the company, is sometimes difficult to distinguish from illegal pyramid or Ponzi schemes, although legal and reputable MLMs exist.

- Pay-as-you-go social insurance: Detractors of the Social Security program in the United States often draw parallels between it and a Ponzi scheme, because people who make payments receive benefits later from payments made by others.[3] Conservative economist Walter Williams adds, "Social Security is unsustainable because it is not meeting the first order condition of a Ponzi scheme, namely expanding the pool of suckers."[4] However, as the Social Security Administration points out, "There is no unsustainable progression driving the mechanism of a pay-as-you-go pension system," and "as long as the amount of money coming in the front end of the pipe maintains a rough balance with the money being paid out, the system can continue forever."[1] See also Social Security debate (United States)#Criticism of Social Security as a Ponzi Scheme.

Notable Ponzi schemes

See also

- High-yield investment program

- Bucket shop (stock market)

- Get-rich-quick scheme

- Matrix scheme

- Double Shah

- White-collar crime

References

- ^ a b "Ponzi Schemes". US Social Security Administration. http://web.archive.org/web/20041001-20051231re_/http://www.ssa.gov/history/ponzi.html. Retrieved on 2008-12-24.

- ^ Utpal Bhattacharya (2003). "The optimal design of Ponzi schemes in finite economies". Journal of Financial Intermediation 12: 2–24. doi:.

- ^ "Why is Social Security often called a Ponzi scheme?". The Cato Institute. 1999-05-11. http://www.socialsecurity.org/daily/05-11-99.html. Retrieved on 2008-03-04.

- ^ Williams, Walter (February 4, 2009), "The National Ponzi Scheme", Capitalism Magazine, http://www.capmag.com/article.asp?ID=5409

| This article needs additional citations for verification. Please help improve this article by adding reliable references. Unsourced material may be challenged and removed. (December 2008) |

Further reading

- Dunn, Donald (2004). Ponzi: The Incredible True Story of the King of Financial Cons (Library of Larceny) (Paperback). New York: Broadway. ISBN 0767914996.

- Zuckoff, Mitchell (2005). Ponzi’s Scheme: The True Story of a Financial Legend. New York: Random House. ISBN 1400060397.

External links

| ||

| ||